Closing costs are known to be the fees that the buyer or the seller has to pay, at the time of closing, in order for the property to switch hands. In pretty much every real estate transaction, the buyer and the seller will have their own set of closing costs. Depending on which side of the transaction you are on, your closing costs could be more or less. If you are reading this article, you most likely have some interest in purchasing a home. When you look to purchase a home, the biggest question I hear a lot is “How much money will I need?”

Buyers, for the most part, understand that they will need to bring a down payment to buy a home. Down payments will differ depending on the type of home loan you are getting. Check out these articles regarding down payments of FHA, Conventional, USDA, and also VA home loans.

Are closing costs and down payment the same thing?

Not exactly. Most buyers do not know that there are also closing costs involved that are outside of the down payment. Nonetheless, these are both paid at “time of closing”. Closing is the last step in the process where you sign all of the documents and exchange all of the money. It’s important to know what your closing costs consist of. This will vary by state so please check with a local real estate agent to find out the numbers for your state.

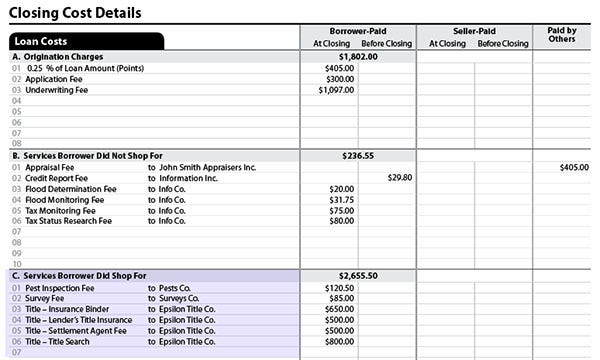

The best way to get a look at closing costs is to view a Closing Disclosure. A closing disclosure is a document that will be given to you as the buyer, that will outline all of the costs associated with you purchasing the home. It looks something like this:

Texas Closing Disclosure

Now again, this document can vary by state. For the most part, it will list out the buyer and the sellers settlement charges or -closing costs.

Since real estate transactions are highly negotiated, there are some things that can be paid by the other side in the transaction if negotiated correctly. To get a better understanding of the closing costs specifically for the buyer, we must look a bit deeper into the Closing Disclosure document.

Buyers Closing Costs Disclosure

In the above image, it shows a breakdown of possible borrower closing costs. Again, these can vary by what is negotiated in the contract but for the most part, these are the things borrowers will often pay for at closing.

Here is the breakdown of the common charges:

- Loan origination charges

- Application fee

- Underwriting fee

- Appraisal fee

- Credit report fee

- Misc lender charges

- Survey fee

- Title insurance

- Lenders title insurance

- Misc title charges

Most of the charges mentioned above may be different depending on which lender or title company you use in the transaction. It’s always best to shop around to make sure you are not going to be paying for something you don’t need to.

When it comes down to closing on a home, I recommend that you have an additional 3% of sales price to pay for your closing costs. This 3% is not including your down payment.

Can the seller pay my closing costs?

Absolutely. In Texas real estate contracts, there is an area where closing costs can be negotiated. A buyer can ask the seller to pay some or even all of their closing costs. Now, if you’ve read my book, More Than Four Walls, I’m sure you understand this area of negotiation very well.

I don’t want the idea of paying closing costs to scare you away from buying a home. Instead, it should make you feel more educated. One important thing you want to do is, assess your financial situation. Check to see what you can afford. If it does not seem that you can afford to pay closing costs and your down payment, make sure your real estate agent knows that. With this information, they can make sure that they are negotiating efficiently on your behalf. I recently recorded a video with one of my buyers where we spoke about what she actually had to bring to close. The number will surprise you. Check out that video here.

If you’re up in the air about whether or not you should buy a home, I want you to check out this article. It’s titled “How Do I Know It’s The Right Time To Buy a Home” This article goes into other factors to consider, aside from closing costs, when purchasing a home.

No comments:

Post a Comment